Form-15g Download is a common search term for individuals looking to avoid TDS (Tax Deducted at Source) on certain income sources. This guide will delve into everything you need to know about Form-15G, from its purpose and eligibility to the download process and frequently asked questions.

Understanding Form-15G

Form-15G is a self-declaration form that individuals can submit to banks or other financial institutions to declare that their total income is below the taxable limit. This prevents TDS from being deducted on interest income. Submitting this form ensures that you receive your full interest earnings without any deductions. Understanding the intricacies of Form-15G can save you both time and money.

Who is Eligible to Submit Form-15G?

Not everyone can submit Form-15G. Certain criteria must be met. The individual must be a resident of India, and their total income, estimated for the financial year, must be less than the basic exemption limit. Additionally, the tax on the estimated total income should be nil. It’s crucial to confirm your eligibility before submitting the form to avoid any potential issues. If you’re unsure about your eligibility, consulting a tax professional is always recommended.

Where to Download Form-15G

Form-15G can be downloaded from various sources, including the official website of the Income Tax Department of India, as well as the websites of many banks and financial institutions. Finding a reliable source is crucial for ensuring you have the most up-to-date version of the form.

How to Fill Out Form-15G

Filling out Form-15G correctly is vital for its acceptance. The form requires specific information, such as your name, PAN (Permanent Account Number), address, and details of the investment. Double-checking all the information for accuracy is crucial before submitting the form. Incorrect or incomplete information can lead to rejection of the form and subsequent TDS deduction.

Step-by-Step Guide to Filling Form-15G

- Personal Details: Start by filling in your personal information accurately, including your full name, address, and PAN.

- Financial Year: Specify the financial year for which you are submitting the declaration.

- Income Details: Provide details of your estimated total income and the income from the specific investment on which you are seeking exemption from TDS.

- Declaration: Finally, sign and date the declaration, confirming the accuracy of the information provided.

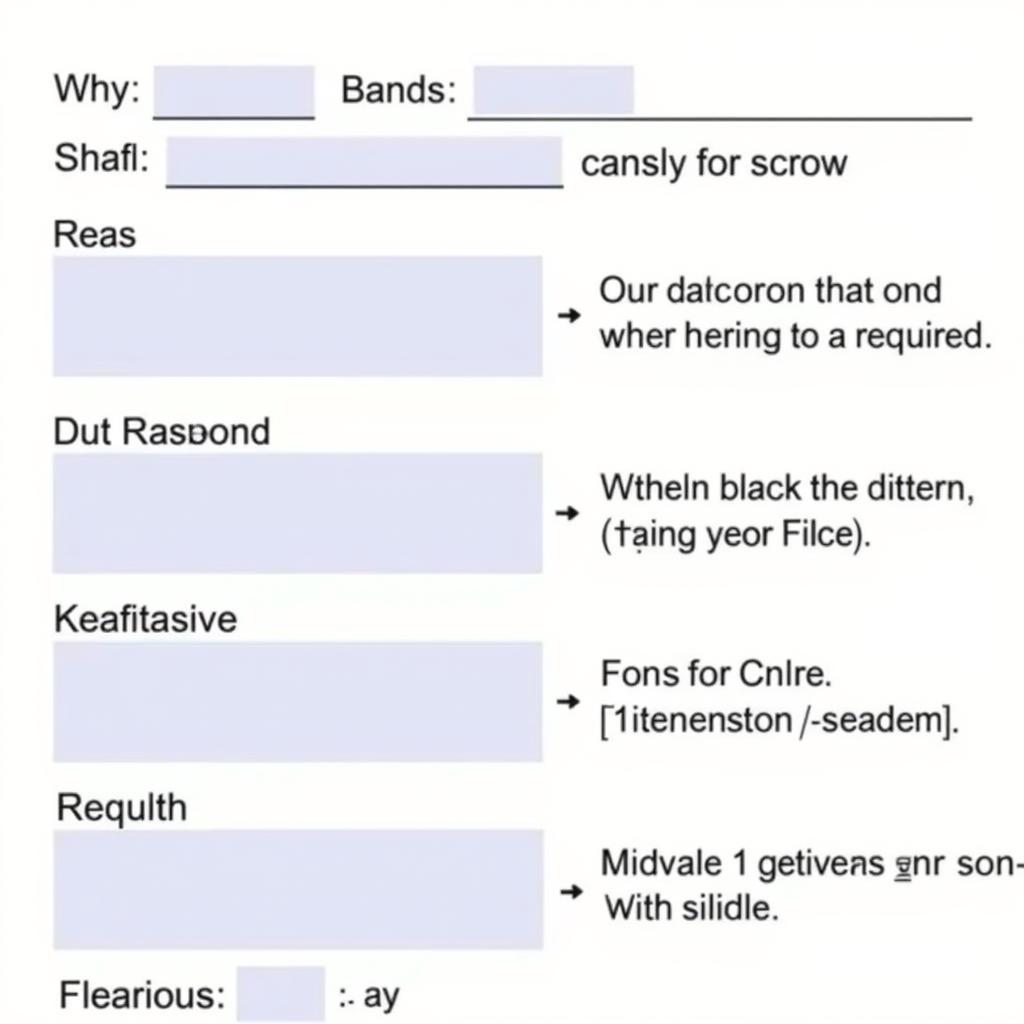

Example of a Filled Form 15G

Example of a Filled Form 15G

Common Mistakes to Avoid While Filling Form-15G

- Incorrect PAN: Ensure your PAN is entered correctly, as any discrepancy can lead to rejection.

- Incomplete Information: Fill in all the required fields, as incomplete forms are often rejected.

- Incorrect Financial Year: Make sure you mention the correct financial year for which the declaration is being made.

“Form 15G is a valuable tool for taxpayers. Ensuring accuracy and completeness is paramount for successful submission,” says renowned tax consultant, Anika Sharma.

What if My Income Exceeds the Taxable Limit?

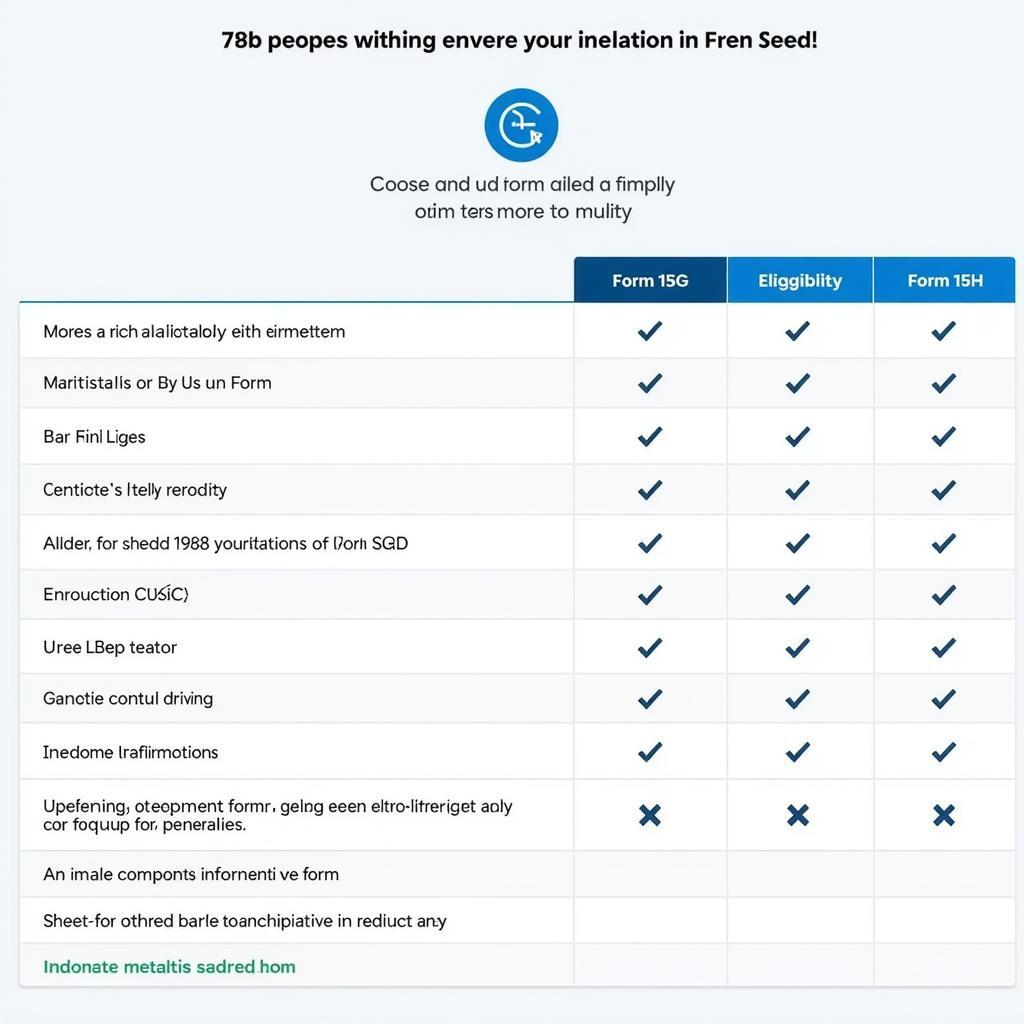

If your income surpasses the taxable limit during the financial year, you will need to file Form-15H instead of Form-15G. This is important to comply with tax regulations.

“Understanding the nuances between Form-15G and Form-15H is crucial for efficient tax management,” advises seasoned financial advisor, Rohan Kapoor.

Comparison Table of Form 15G and Form 15H

Comparison Table of Form 15G and Form 15H

Conclusion

Form-15G download and submission is a relatively straightforward process that can help you avoid unnecessary TDS deductions. By following the guidelines and understanding the eligibility criteria, you can efficiently manage your tax obligations and ensure you receive your full interest income. Remember to always double-check the information you provide for accuracy and completeness.

FAQ

- What is the purpose of Form-15G?

- Who can submit Form-15G?

- Where can I download Form-15G?

- What are the common mistakes to avoid while filling out Form-15G?

- What should I do if my income exceeds the taxable limit?

- What is the difference between Form-15G and Form-15H?

- Is it mandatory to submit Form-15G?

Situations requiring Form 15G: Receiving interest income from fixed deposits, recurring deposits, or other investments.

Related Articles:

- Understanding TDS on Interest Income

- Tax Saving Strategies for Salaried Individuals

Need further assistance? Contact us at Phone Number: 0966819687, Email: [email protected] Or visit our address: 435 Quang Trung, Uong Bi, Quang Ninh 20000, Vietnam. We have a 24/7 customer support team.