Navigating the world of taxes can be daunting, especially in the Philippines. One crucial document for Filipino taxpayers is the BIR Form 1701, also known as the Annual Income Tax Return for Individuals. Whether you’re a freelancer, a professional, or someone who needs to file their annual income tax, understanding and downloading BIR Form 1701 is essential. This comprehensive guide provides everything you need to know about downloading, filling out, and submitting this vital form.

What is BIR Form 1701?

The BIR Form 1701 is a self-declared tax form that individuals and certain corporations use to report their annual income, deductions, and tax liabilities to the Bureau of Internal Revenue (BIR). It’s your responsibility as a taxpayer to ensure your information is accurate and submitted on time to avoid penalties.

Who Needs to File BIR Form 1701?

Not all individuals in the Philippines are required to file BIR Form 1701. Here’s a breakdown of who needs to file:

- Individuals earning purely compensation income: Those employed with a single employer and whose taxes are withheld through the Pay-As-You-Earn (PAYE) system are generally exempt from filing.

- Individuals earning mixed income: If you earn income from both employment and other sources, such as freelance work or business, you must file BIR Form 1701.

- Self-employed individuals and professionals: Freelancers, entrepreneurs, and professionals must file this form to declare their business or professional income.

Downloading BIR Form 1701

Downloading BIR Form 1701

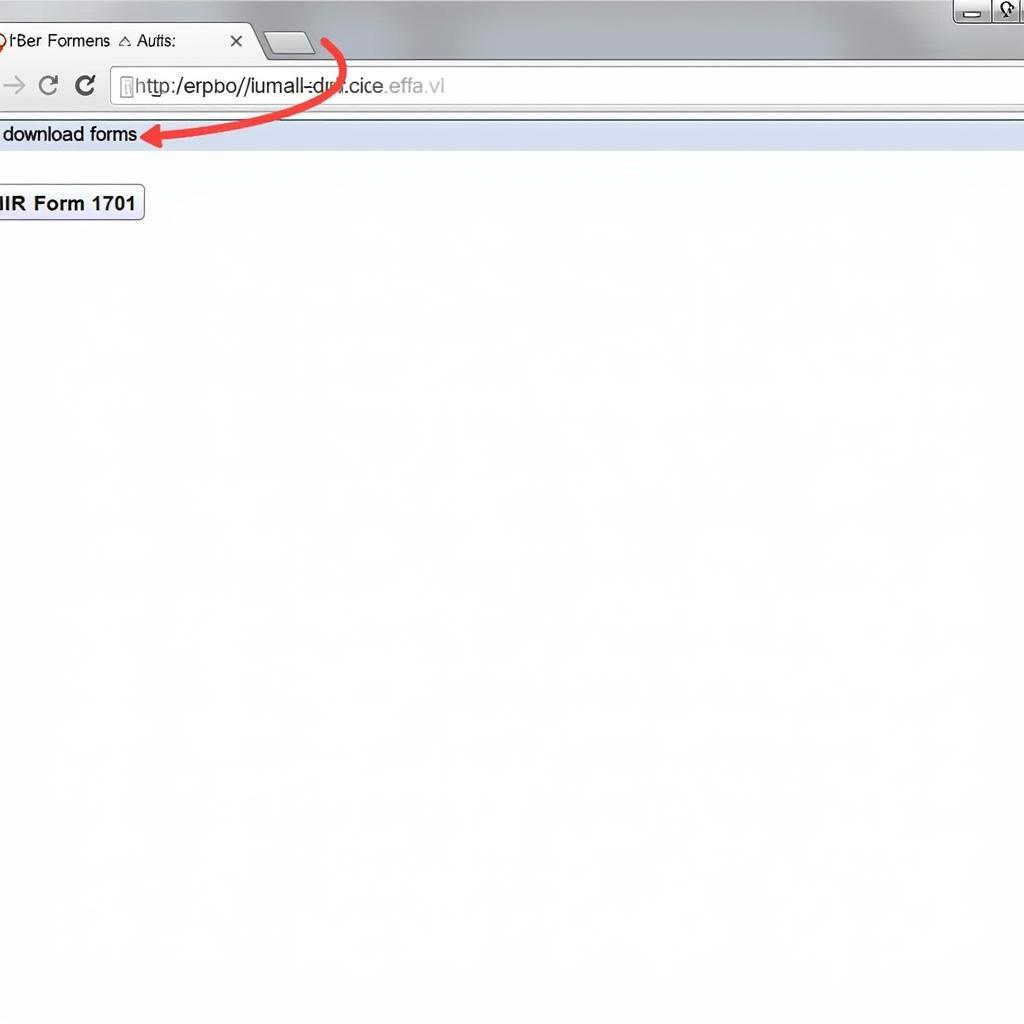

Where to Download BIR Form 1701

The most reliable source for downloading the latest version of BIR Form 1701 is the official BIR website.

- Visit the BIR Website: Go to the official BIR website (https://www.bir.gov.ph).

- Navigate to “Forms”: Look for a section labeled “Forms” or “Downloads” on the BIR homepage.

- Find Form 1701: You can usually search for forms by their name or number. Search for “BIR Form 1701” or “1701.”

- Download the Form: Click on the link to download the form. It is usually available in PDF format.

Always ensure you are downloading the form from the official BIR website to avoid outdated or incorrect versions.

Filling Out BIR Form 1701

Filling out tax forms can be confusing. Here’s a simplified guide to help you:

1. Basic Information: Provide your Taxpayer Identification Number (TIN), name, address, and other personal information accurately.

2. Income Section: Declare all your income sources for the year. This includes salary from employment, business income, freelance earnings, and income from other sources.

Filling Out BIR Form 1701

Filling Out BIR Form 1701

3. Deductions and Exemptions: Claim allowable deductions, such as health insurance premiums or contributions to retirement plans, to reduce your taxable income.

4. Tax Computation: Calculate your tax liability based on the tax table provided by the BIR. This section can be complex, so seeking assistance from a tax professional might be helpful if needed.

5. Attachments: Attach supporting documents as required. This may include your income tax return, certificates of credit withholding tax, and other relevant documents depending on your income sources.

6. Signature: Sign and date the form to certify the information is true and correct.

“Accuracy is crucial when filling out tax forms. Double-check all information before submission to avoid penalties or issues with the BIR.” – Maria Santos, Certified Public Accountant

Submitting Your BIR Form 1701

Once you’ve filled out the form and gathered all the necessary attachments, you need to submit it to the BIR:

- Online Filing: The BIR encourages online filing through its eBIRForms system. This method offers convenience and faster processing.

- Manual Filing: You can also print and submit your accomplished BIR Form 1701 to the nearest BIR Revenue District Office (RDO) where you are registered.

Deadlines and Penalties

The deadline for filing your annual income tax return is April 15th of the following year. For example, the deadline for the 2023 tax year is April 15th, 2024.

Late filing or payment of taxes may result in penalties, such as surcharges and interest.

Tips for a Smooth Filing Experience

- Organize your financial records: Keep track of all your income and expenses throughout the year.

- Seek professional help: If you’re unsure about any part of the process, don’t hesitate to consult with a certified public accountant or a tax professional.

- File early: Don’t wait until the last minute to avoid the rush and potential delays.

- Keep updated on tax laws: Tax regulations can change. Stay informed about any updates or revisions.

Submitting BIR Form 1701

Submitting BIR Form 1701

Conclusion

Understanding and correctly filing BIR Form 1701 is a crucial responsibility for Filipino taxpayers. By following this guide and staying informed about tax regulations, you can navigate the process confidently and fulfill your tax obligations.