The investment world eagerly seeks the wisdom of Seth Klarman, the elusive value investing guru and author of the highly sought-after book, “Margin of Safety: Risk-Averse Value Investing Strategies for the Thoughtful Investor.” This book, now out of print and fetching astronomical prices on the secondhand market, has become something of a legend. Many aspiring investors find themselves on the hunt for a “Margin Of Safety Seth Klarman Pdf Free Download.” But is this quest realistic, or even advisable?

The Allure of Klarman’s Margin of Safety

Seth Klarman’s “Margin of Safety” isn’t just another investment book. It’s a comprehensive guide to value investing, a philosophy championed by Benjamin Graham and practiced with remarkable success by Warren Buffett. Klarman dives deep into the core principles of identifying undervalued assets, understanding intrinsic value, and navigating market fluctuations with a long-term perspective.

The book’s scarcity has only amplified its mystique. Original copies are practically nonexistent, with used versions often listed for thousands of dollars. This has naturally led to a surge in online searches for a free PDF version.

The Legality and Ethics of Free Downloads

While the temptation to find a “margin of safety seth klarman pdf free download” is understandable, it’s crucial to consider the legal and ethical ramifications. Downloading copyrighted material without permission is a violation of intellectual property rights.

Furthermore, supporting such activities undermines the hard work and dedication authors put into their creations. Authors deserve to be compensated for their intellectual property, and free downloads deprive them of rightful earnings.

The Value of a Legitimate Copy

Instead of pursuing a “margin of safety seth klarman pdf free download,” consider the long-term benefits of obtaining a legitimate copy. While it might require a more significant investment upfront, the knowledge and insights gained from Klarman’s work can have a lasting impact on your investment journey.

Owning a physical copy allows you to engage with the material actively, highlighting key passages, and revisiting important concepts. Moreover, supporting authors through legal channels contributes to a thriving literary and investment community.

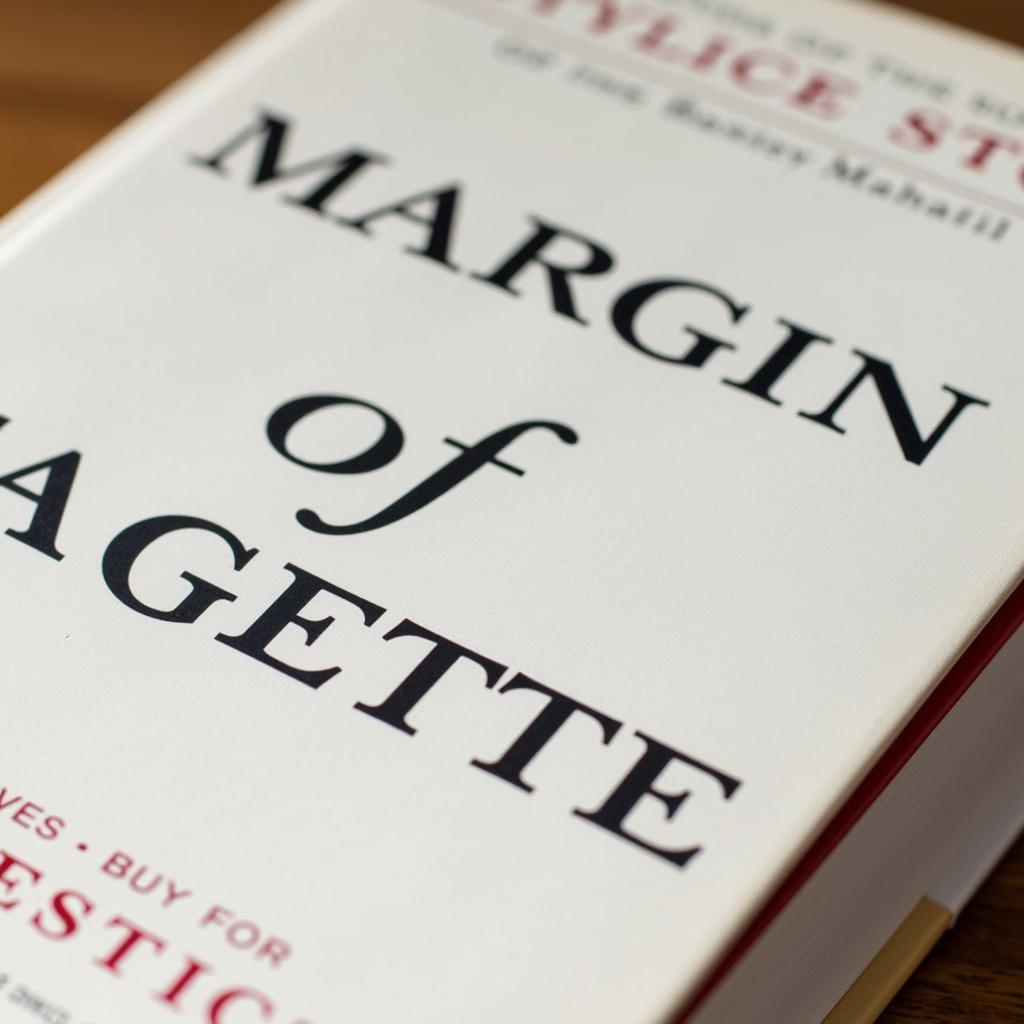

Seth Klarman's Margin of Safety Book Cover

Seth Klarman's Margin of Safety Book Cover

Alternative Avenues to Access Klarman’s Wisdom

If a physical copy remains elusive or financially out of reach, there are alternative ways to tap into Klarman’s investment philosophy:

- Public Libraries: Many libraries hold copies of “Margin of Safety” or can order it through interlibrary loan programs.

- Used Bookstores: While prices for used copies can be high, diligently checking local and online used bookstores might yield a more affordable option.

- Excerpts and Summaries: Numerous online articles, blog posts, and book summaries provide excerpts and key takeaways from “Margin of Safety,” offering a glimpse into Klarman’s core principles.

- Value Investing Resources: Explore the wealth of resources available on value investing, including books, websites, and forums, to deepen your understanding of the principles Klarman advocates.

Visual Representation of Value Investing

Visual Representation of Value Investing

The Enduring Relevance of Klarman’s Teachings

While “Margin of Safety” might be challenging to obtain, the principles it espouses remain timeless and universally applicable to sound investment decision-making. By focusing on understanding intrinsic value, managing risk effectively, and adopting a long-term perspective, investors can navigate market complexities with greater confidence and potentially achieve superior returns.

The quest for a “margin of safety seth klarman pdf free download” highlights the book’s enduring appeal and the widespread desire to access its valuable insights. However, it’s essential to remember that ethical considerations and supporting authors’ rights are paramount. By exploring alternative avenues and focusing on the timeless principles Klarman champions, investors can embark on a rewarding journey toward financial success.